Conservation is not something accomplished with a single act or in a single instance. Rather, conservation is a lifestyle and a lifelong commitment to a philosophy that we can take action to make the world a better place. What better way to immortalize a lifetime legacy of conservation than with a planned gift that will impact our Center’s work for generations to come?

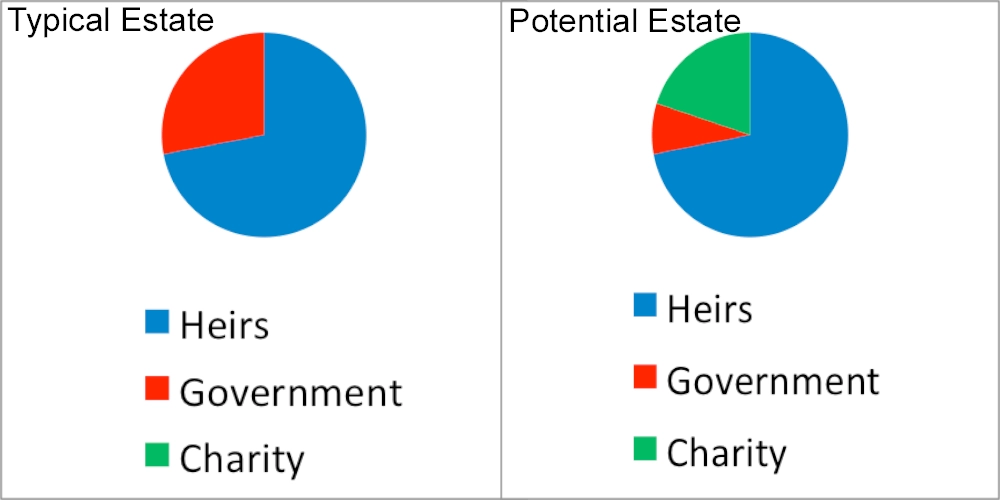

We can help you create an estate plan that fulfills your family commitments, minimizes government taxes, and honors nonprofit organizations like the Avian Conservation Center, as demonstrated by the estate graph displayed here. Below are some of the ways we can help you craft this plan with your financial advisor.

Please contact our office at 843-971-7474 or at membership@thecenterforbirdsofprey.org for more detailed information or to schedule a personal meeting about making a planned gift.

Images courtesy of Thompson & Associates, Values-Based Estate Planning

Gifts "Anyone Can Make"

- Bequests in our Will or Trust

- Stock and appreciated securities

- Life insurance

- Stock

- Tangible personal property

- Real estate

- Retirement plans

- Donor advised funds

Gifts That Pay Income

- Charitable Gift Annuities (Immediate, Deferred, and Flexible)

- Charitable Remainder Annuity Trusts

- Charitable Remainder Unitrusts

- Pooled income funds

Gifts That Protect Assets

- Charitable Lead Trusts

- Retained Life Estates

I hereby give, devise and bequeath ____ percent (___%) of my total estate, determined as of the date of my death, to the Avian Conservation Center, a nonprofit organization located at 4719 Highway 17 N, Awendaw, SC 29429, with a mailing address of P. O. Box 1247, Charleston, SC 29402, Federal Tax ID #57-0966813, for the Center’s general use and purpose.If you would like sample language for outright bequests of a specific dollar amount, personal property, or real estate; residuary bequests; or contingent bequests, please contact our office at 843-971-7474 or email membership@thecenterforbirdsofprey.org.